Home > Open Banking Products > Turnkey 1033 Solutions > TPP

Open Banking Third-Party Provider (TPP) Solution

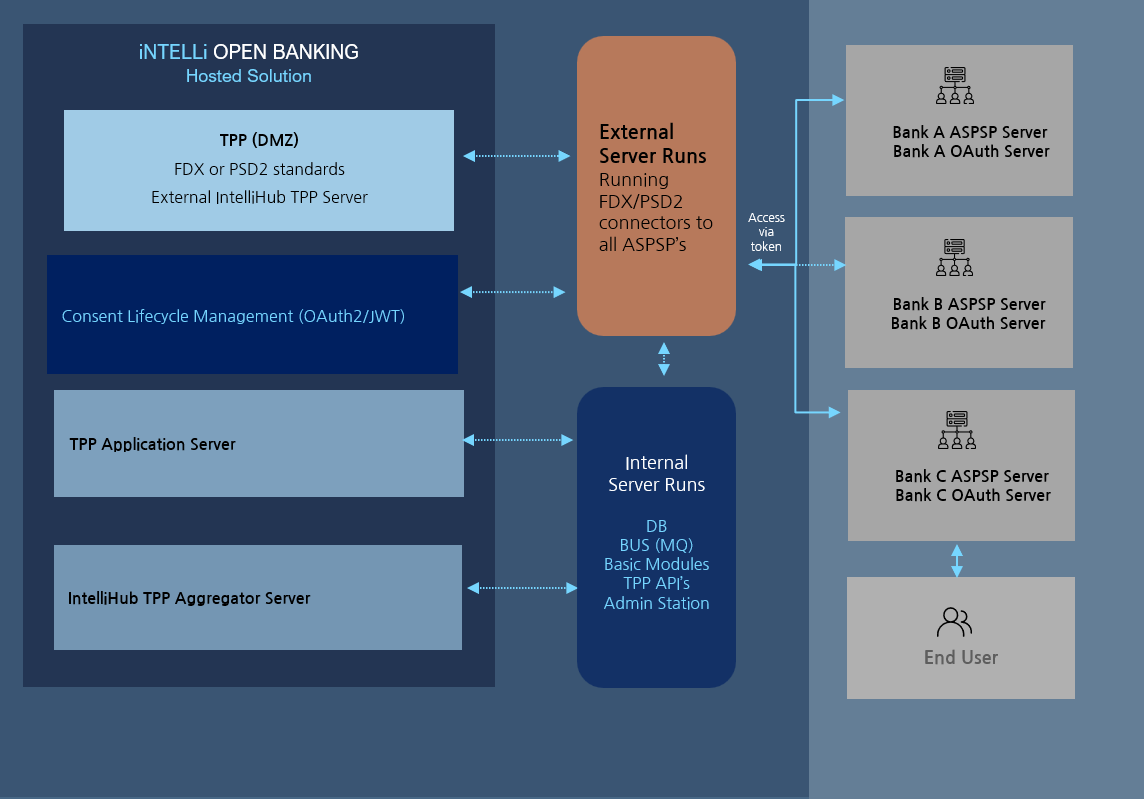

Intelli Open Banking’s TPP solution enables financial institutions to securely receive data and initiate payments from external sources while maintaining strict CFPB 1033 compliance. By leveraging real-time insights across multiple providers, financial institutions can offer innovative products, grow customer engagement, and retain full control over who they connect with as part of their open banking strategy.

Benefits of TPP for Open Banking

-

PSD2/FDX API Support: Adapts to European and U.S. standards for seamless compliance.

-

Extensions Support: Keeps TPP capabilities updated without costly rebuilds.

-

Consent Management: Tracks real-time user permissions for compliance and transparency.

-

PSU Aggregate Calls: Consolidates data across ASPSPs for unified account views.

-

Multiple TPP Support: Integrates with various providers to expand services easily.

-

Enterprise Features: Ensures scalability, redundancy, and high availability for open banking.

-

Regulatory Reports: Delivers activity insights to simplify compliance audits.

-

INTELLIHUB Integration: Adds data enrichment and analytics to TPP workflows for actionable insights.